Chapter 1: The Emotional Roller Coaster of Bitcoin’s Volatility

Bitcoin, by nature, is a roller coaster. One day it’s up, the next day it’s down, and if you’re not careful, it’ll throw you off track faster than you can blink. But here’s the thing—this constant fluctuation does more than just affect your wallet. It plays mind games with you. If you’re in it for the long haul, you need to understand how this volatility is affecting you on a psychological level.

When you see Bitcoin’s price swing wildly, your brain isn’t just processing numbers. It’s sending signals—signals of fear, anxiety, maybe even greed. This is what we call the “fight or flight” response, and it’s no joke. In the heat of the moment, you’re not thinking rationally. You’re reacting emotionally, and that’s where most investors go wrong. They panic sell when the price dips or get overly confident when it spikes, only to watch it plummet again.

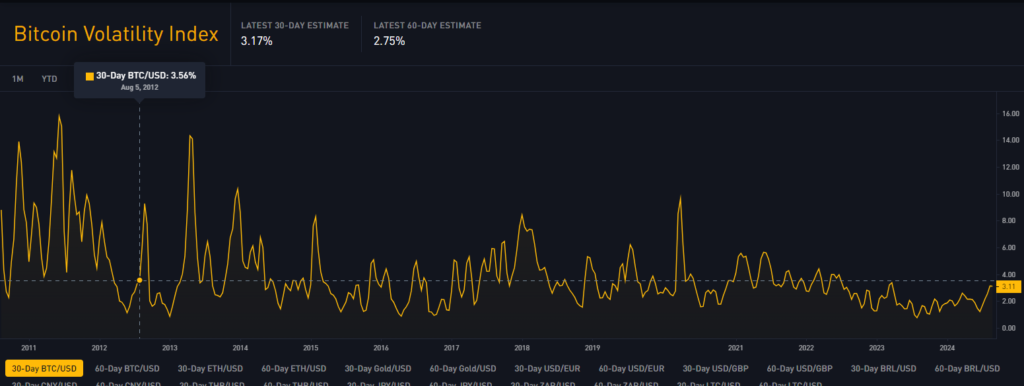

Chapter 2: The Declining Volatility and Its Psychological Impact

Here’s the kicker—Bitcoin’s volatility has been decreasing. And while that might seem like a good thing, it’s a double-edged sword. As volatility decreases, so does the potential for those massive gains you’re chasing. And let me tell you, when the excitement fades, so does the psychological high you get from the thrill of the ride. It’s like going from a wild roller coaster to a kiddie ride. It’s safer, sure, but it’s not what you signed up for.

The declining volatility changes the game. It might make Bitcoin feel more stable, but it also lowers the adrenaline rush that many investors have become addicted to. This can lead to a different kind of psychological challenge—boredom. When the wild swings settle down, you might find yourself missing the action, and that could lead to poor decision-making as you chase that lost excitement.

Chapter 3: Mastering Your Emotions in a Changing Market

So, what does this mean for long-term investors like you? It means you need to get your head in the right place. You have to detach emotionally. Stop checking the price every five minutes. Understand that Bitcoin is playing the long game, and so should you. The moment you start making decisions based on emotions instead of strategy, you’ve lost the game.

And don’t get me wrong—this is easier said than done. It takes discipline, patience, and a whole lot of self-control. But if you can master this, if you can learn to ride the waves without getting seasick, you’ll be ahead of the pack. You’ll be the one who stayed cool when everyone else was losing their minds.

Chapter 4: The Long Game—Staying Cool Amidst Market Changes

Next time you see Bitcoin’s price move, take a step back. Breathe. Remember that this is all part of the journey. And more importantly, remember that Bitcoin’s volatility, while still present, is decreasing. It’s maturing, and so should your investment strategy. Don’t let the market’s ups and downs dictate your mental state. Instead, focus on the bigger picture. That’s how you stay in the game, and that’s how you win.

If this resonated with you, make sure you’re subscribed for more insights. Stay sharp, stay focused, and remember—the best investors are the ones who can keep their cool, no matter what the market throws at them.